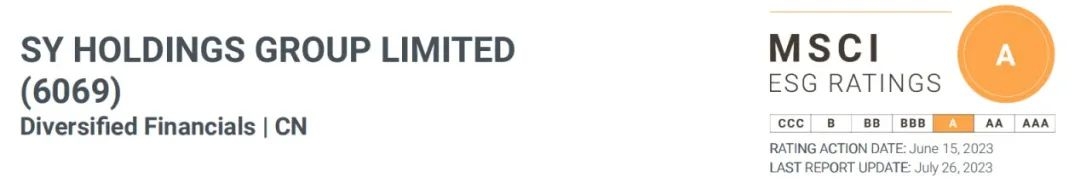

In 25 September 2023, SY Holdings Group Limited ("SY Holdings" or the "Group"; Stock Code: 6069.HK) has been awarded an MSCI ESG "A" rating for 2023, maintaining its top-tier position since first achieving this distinction in 2021. This recognition places SY Holdings among the top 23% of global financial firms assessed by MSCI, the world's most influential ESG rating agency. The evaluation commended SY Holdings' exceptional performance in three critical areas: Corporate Governance, Inclusive Finance, and Carbon Reduction.

In Corporate Governance, SY Holdings has established a three-tier ESG management structure (Board → Task Force → Departments) and aligns its operations with six UN Sustainable Development Goals (SDGs), including climate action and reduced inequalities. In Inclusive Finance, the Group demonstrated strong support for small and medium-sized enterprises (SMEs), with 98% of its 2023 first-half financing clients being SMEs, totaling RMB 12.9 billion in SME financing—a 35% year-on-year growth. In Carbon Reduction, SY Holdings saved over three million sheets of paper (equivalent to 256 tons of CO₂) and achieved 100% paperless operations through its SYT Cloud Platform.

SY Holdings' ESG integration reflects a sustainable business model in action, emphasizing digital transformation, green finance, and technological innovation. The Group enables carbon-efficient supply chains through industrial internet solutions, develops sustainable financial products for low-carbon projects, and implements tech-driven features like e-signatures and smart document analysis to eliminate paper use.

Commenting on the achievement, SY Holdings stated, "Retaining our 'A' rating validates our mission to make finance both inclusive and sustainable. By combining our proprietary tech platform with ESG-conscious financing, we're helping 16,000+ SMEs grow while reducing industry-wide carbon footprints."

When compared to industry averages, SY Holdings outperforms significantly, with a 98% SME client ratio (vs. 72% industry average), 100% paperless adoption (vs. 54%), and an ESG governance score of AA (vs. BBB).

Moving forward, SY has outlined forward commitments, including expanding green factoring products in 2024, achieving over 50% tech revenue contribution by 2025, and maintaining a 0% non-performing loan (NPL) ratio in SME financing.