Sustainable Development Policy

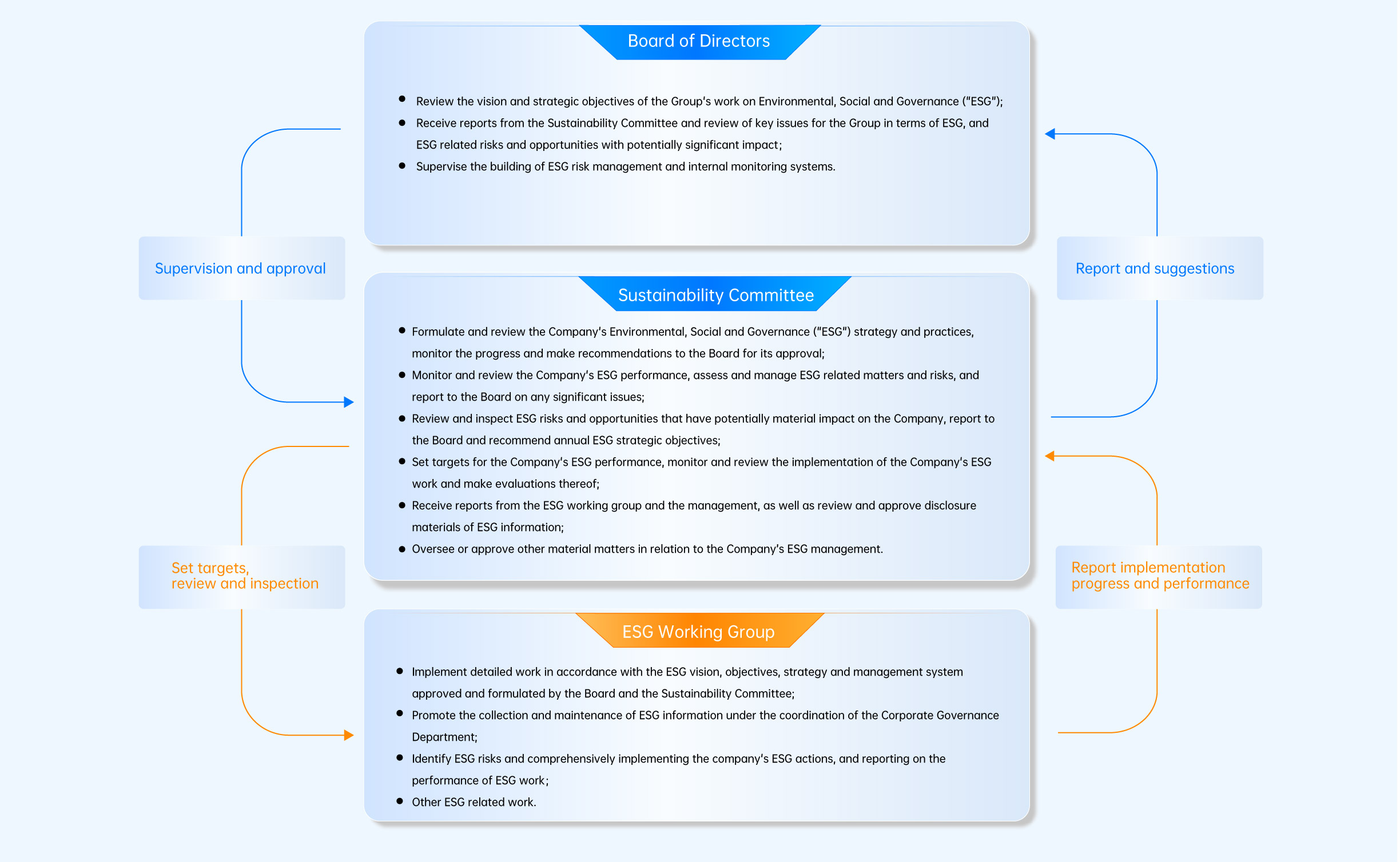

ESG Governance Structure

ESG Policy

Material Topics

SY Charity Foundation

To fulfill SY's commitment to charity in a better and more sustainable manner, the SY Charity Foundation adheres to the principles of sharing and growth and focuses on offering care and help to people in need. The Foundation is committed to promoting public welfare across three areas: Caring for Children in Need, Youth Motivation Program, and Supporting Rural Revitalization, all with the goal of contributing to the harmonious development of society.

Caring For Children in Need

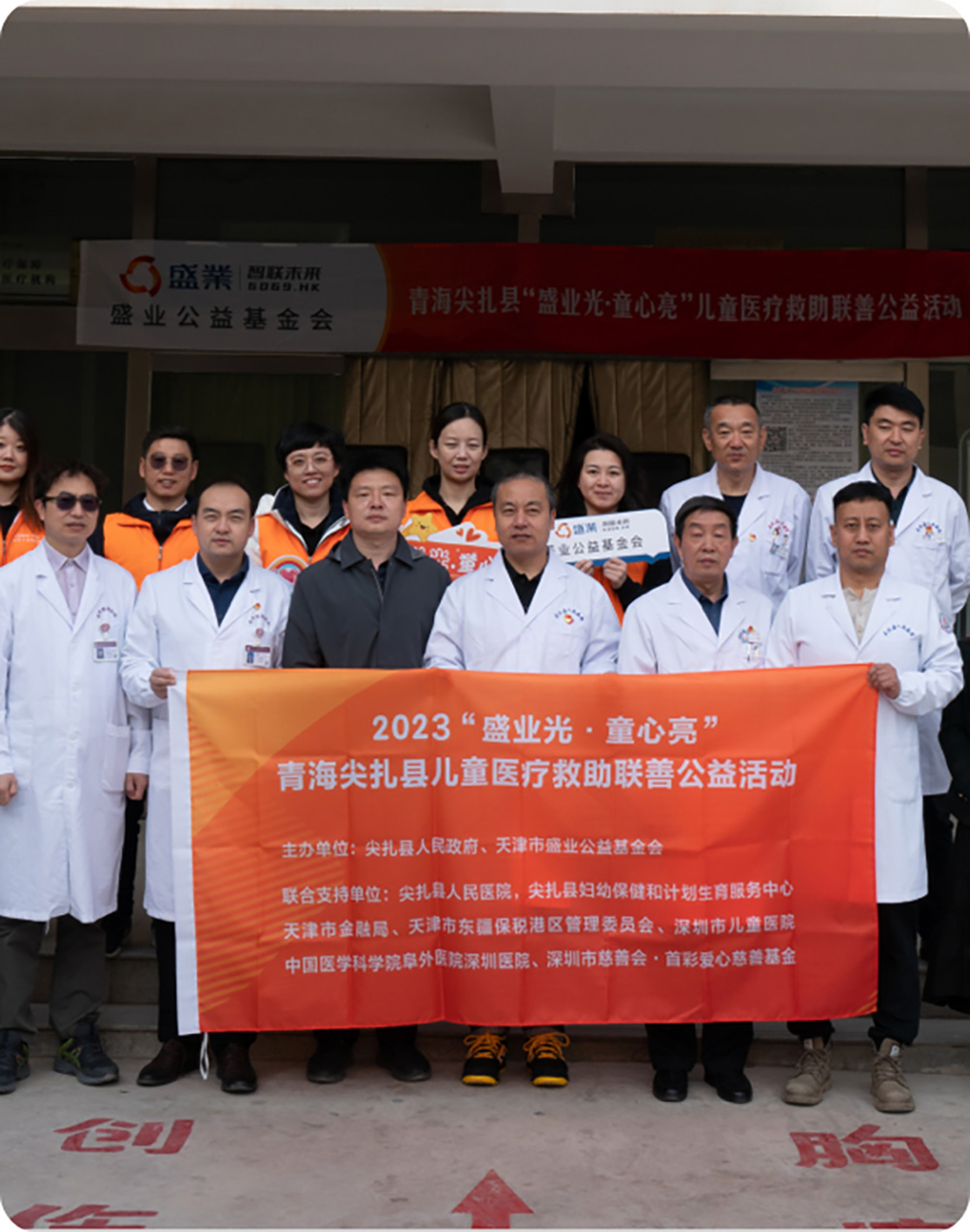

“SY Bright Hearts” Children's Medical Assistance Project

“Little Migratory Birds at Construction Sites Summer Camp” for Children of Migrant Workers

“Young Sunflower” Actions for Children’s Care and Protection

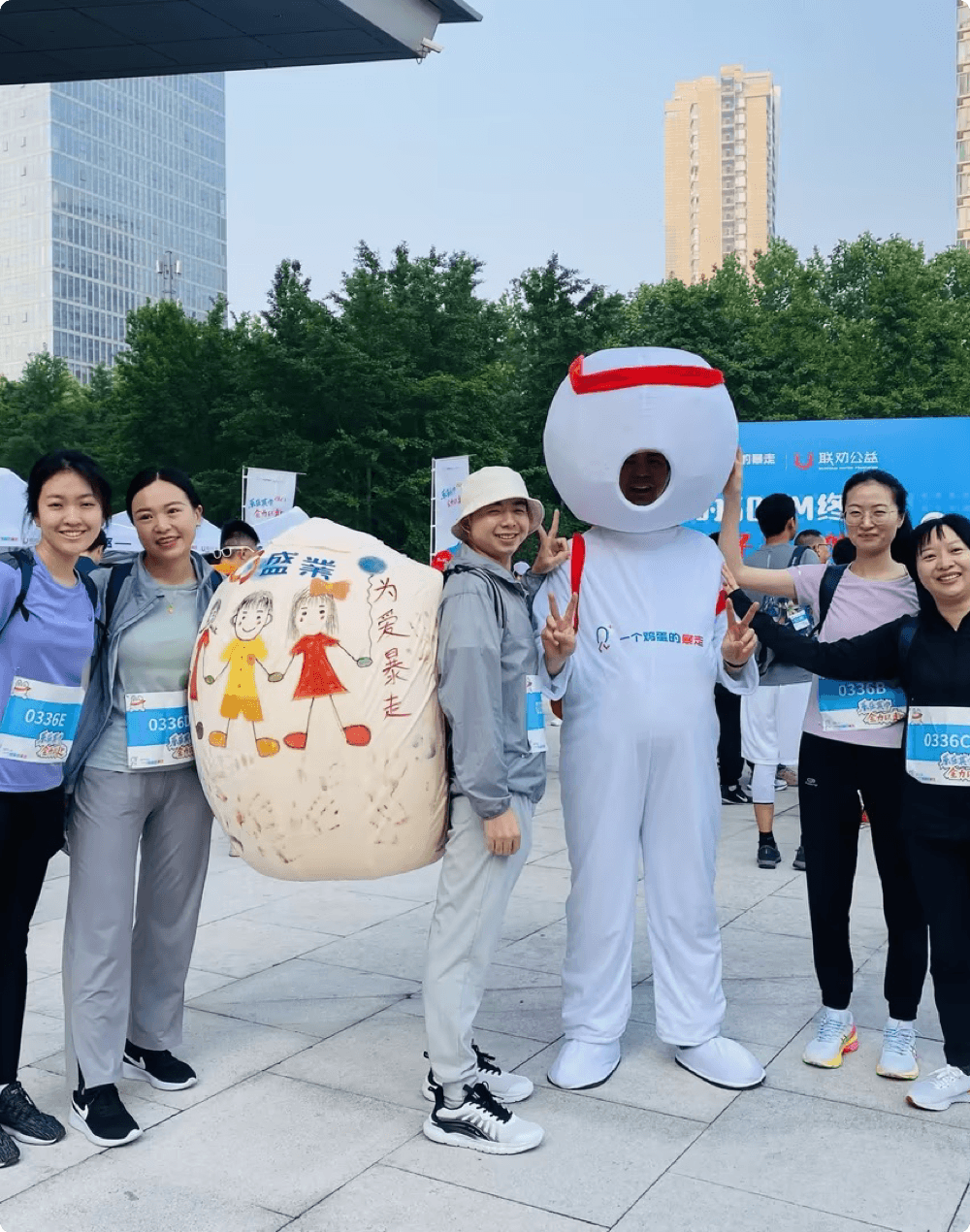

The E.G.G. Walkathon

Book/Clothing Donation

Youth Motivation Program

Financial Aid for Impoverished College Students

“Factoring Talent Scholarship” Program

Supporting Rural Revitalization

Xiaojinzhuang Village Assistance Project

Improving Teaching Conditions at Tunzi Middle School

Improving Teaching Facilities at Zhuguanlong School

Supporting Poverty Alleviation through the Tea Plantation Industry in Xiadang Town, Fujian

“SY Bright Hearts” Children's Medical Assistance Project

Improving Teaching Facilities at Zhuguanlong School

The E.G.G. Walkathon

“Factoring Talent Scholarship” Program

Sustainable Finance

Social Financing Framework

Sustainability-Linked Financing Framework