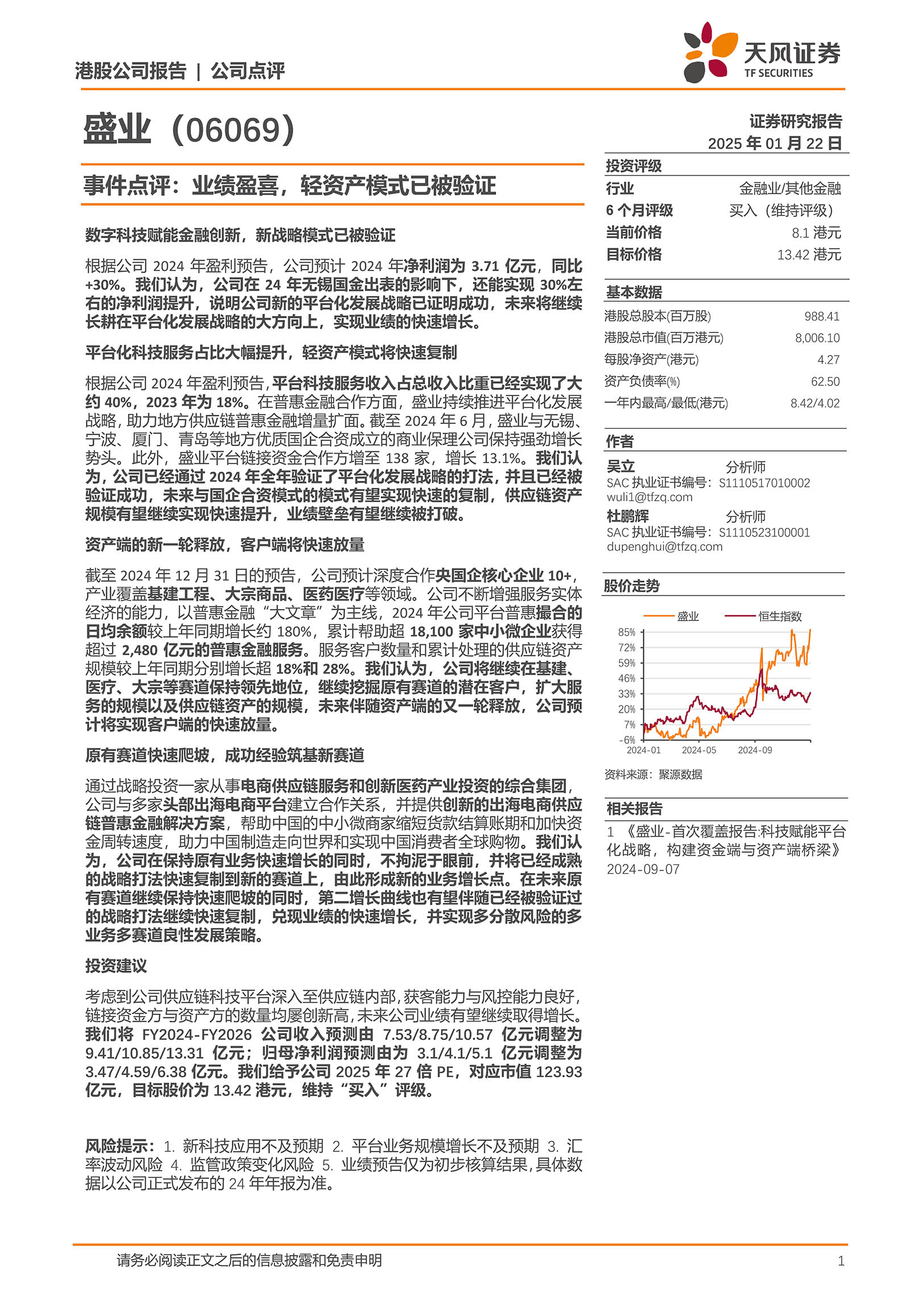

2025 Jan 22,Tianfeng Securities released a research report titled *"SY (06069.HK): Positive Profit Alert, Light-Asset Model Validated"*, highlighting that SY's supply chain technology platform has deeply integrated into supply chain operations, demonstrating strong customer acquisition capabilities and risk management proficiency. The platform has consistently achieved record highs in connecting both fund providers and asset holders, positioning SY for sustained future growth.

As a result, Tianfeng has upgraded its revenue and net profit attributable to parent company forecasts for SY. The firm maintains a "Buy" rating with a target price of HK$13.42.

Digital Tech Drives Financial Innovation: Proven Strategic Model

According to SY's 2024 profit alert, the company expects to achieve approximately RMB 371 million in net profit, representing year-on-year growth exceeding 30%.

Tianfeng Securities analysts note that SY delivered this 30% net profit increase despite the impact of Wuxi International Factoring's divestment in 2024, demonstrating the successful execution of its new platform-based development strategy. The report confirms SY will continue deepening this strategic focus to maintain rapid earnings growth.

Platform-based Technology Services See Significant Growth, Light-Asset Model Poised for Rapid Scaling

According to SY's 2024 profit forecast, revenue from platform technology services now accounts for approximately 40% of total revenue, a significant increase from just 18% in 2023. In advancing inclusive finance partnerships, SY continues to execute its platform-based development strategy, effectively expanding the coverage and scale of regional supply chain financing services.

Tianfeng Securities analysts conclude that SY has successfully validated its platform strategy throughout 2024. With this proven model, the company is well-positioned for rapid replication across markets. This expansion is expected to drive continued acceleration in supply chain asset scale while breaking through existing performance barriers.

New Wave of Asset Deployment to Drive Rapid Client-Side Scaling

SY's 2024 profit forecast reveals significant strategic advancements, including the establishment of deep partnerships with over 10 central state-owned enterprises (SOEs) and key corporations across infrastructure engineering, healthcare/pharmaceuticals, and commodity sectors. The company has demonstrated strengthened capabilities in serving the real economy through its focused strategy on inclusive finance initiatives, achieving remarkable 2024 results: 180% year-on-year growth in average daily balance of platform-facilitated inclusive financing, service provision to over 18,100 SMEs with cumulative inclusive financing exceeding RMB 248 billion, and an 18% increase in total client base alongside 28% expansion in supply chain asset volume year-on-year.

Tianfeng Securities emphasizes SY's maintained sector leadership in infrastructure, healthcare, and commodities, noting the company's strategic position to deepen penetration in core sectors, expand service coverage and supply chain assets, and leverage upcoming asset-side opportunities to accelerate client acquisition. With these new asset-side developments expected to unlock substantial growth potential, SY is well-positioned for rapid scaling of its client portfolio and continued market expansion. This comprehensive progress underscores SY's successful execution of its platform-based strategy and its growing influence in facilitating inclusive financial services across key industrial sectors.

Rapid Scaling in Core Sectors Lays Foundation for New Market Expansion

SY has strategically invested in an integrated group specializing in e-commerce supply chain services and innovative pharmaceutical investments, establishing partnerships with leading cross-border e-commerce platforms. By developing innovative inclusive financial solutions for global e-commerce supply chains, the company is helping Chinese SMEs shorten payment settlement cycles, accelerate capital turnover, facilitate the global expansion of "Made in China" products, and enable worldwide shopping access for Chinese consumers.

Tianfeng Securities observes that while SY continues to demonstrate rapid growth in its core businesses, the company is strategically replicating its proven business model into new sectors to create additional growth drivers. Analysts anticipate this dual-track approach will yield continued accelerated growth in established sectors while developing a strong second growth curve through strategic expansion. The successful replication of SY's validated operational model is expected to deliver rapid earnings growth while implementing a diversified, multi-sector development strategy that mitigates risk. This expansion demonstrates SY's ability to maintain strong performance in its traditional businesses while systematically capturing new market opportunities, creating a balanced portfolio of growth engines across different industry verticals.

Investment Recommendation

Tianfeng Securities maintains a bullish stance on SY, highlighting the company's deeply integrated supply chain technology platform which excels in customer acquisition, risk management, and connecting capital providers with asset holders - capabilities that are expected to drive continued earnings growth. The analyst firm has significantly upgraded its financial projections, now forecasting 2024 revenue at RMB941 million (up from RMB753 million), 2025 at RMB1.085 billion (from RMB875 million), and 2026 at RMB1.331 billion (from RMB1.057 billion). Net profit estimates have similarly been raised to RMB347 million (2024), RMB459 million (2025), and RMB638 million (2026), representing substantial increases from previous forecasts of RMB310 million, RMB410 million and RMB510 million respectively.

Applying a 27x P/E multiple to 2025 earnings, Tianfeng values SY at RMB12.39 billion market capitalization, maintaining its "Buy" rating with a target price of HK$13.42. This optimistic assessment reflects confidence in SY's ability to leverage its technological platform advantages to sustain growth across its supply chain finance operations. The upgraded projections suggest SY is well-positioned to outperform previous expectations, with the revised net profit forecasts implying compound annual growth of approximately 35% from 2024-2026, significantly above initial estimates.